Identifying Major Reversal Patterns

Aug 27, 2023

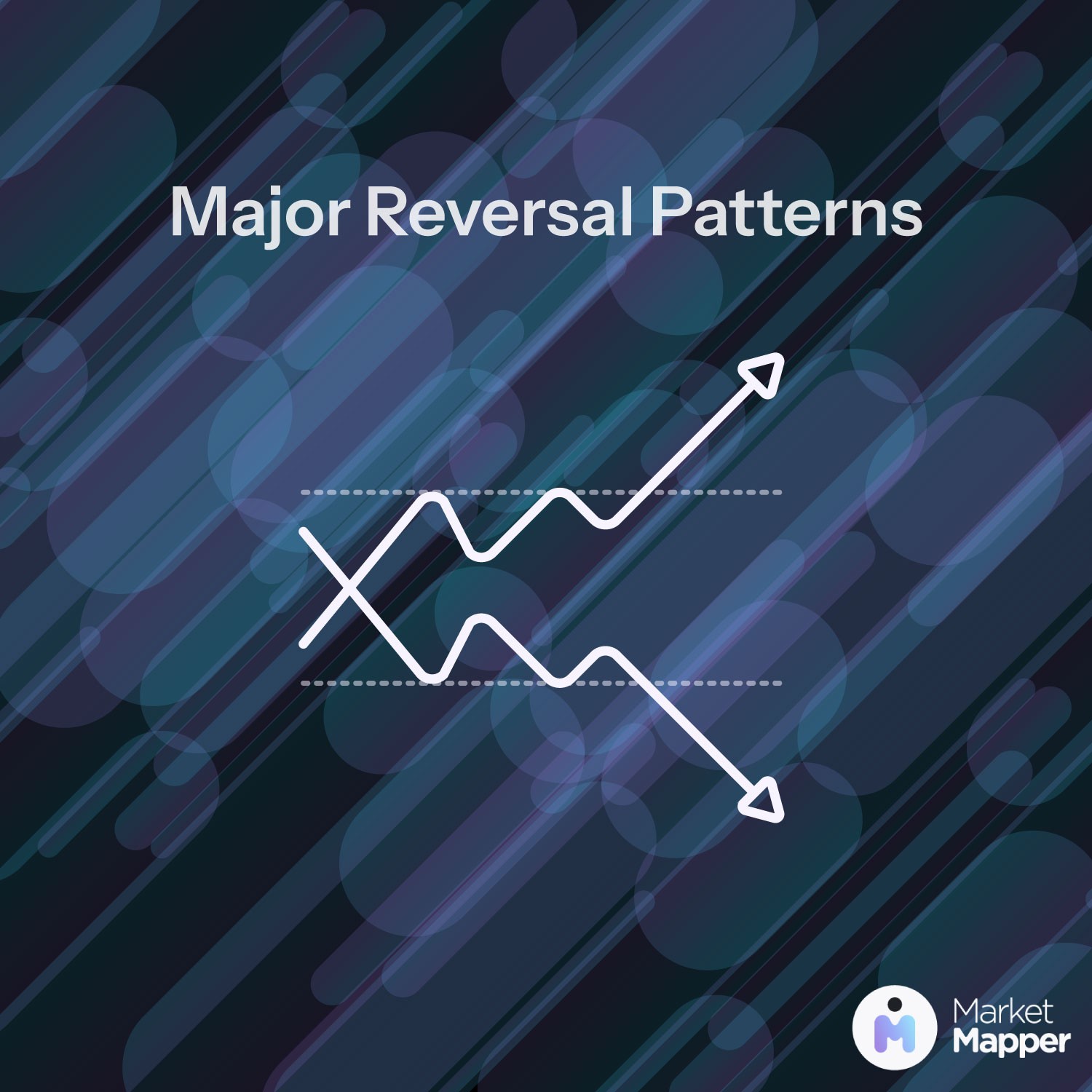

Major reversal patterns are a very important aspect of technical analysis in trading as they provide insights into the potential direction of price movement. Reversal candlestick patterns indicate that an important reversal in trend in taking place.

Types of Patterns

There are two type of patterns: reversal and continuation. But in this post we will be looking at reversal patterns. We often judge trends by the height of the pattern as that is most visually understandable. Though judging by the horizontal width of a pattern is mainly applied for point and figure charting (passage of time is non-existent).

Head and Shoulders: We notice this when a stock's price rises to a peak and then falls. Soon followed by a higher peak and then another fall. The second peak is lower than the first peak while the two lows are at approximately the same level. This pattern is considered a bearish reversal pattern.

Double Top: This pattern is formed when a stock's price reaches a high level, pulls back, then rallies again to the same level before pulling back again. The second rally usually has less volume, indicating decreased buying pressure. This pattern is considered a bearish reversal pattern.

Double Bottom: This is the opposite of the double top pattern. The first bottom typically has high trading volume and is followed by a bounce in price. After the bounce, the price declines again to the same level as the first bottom, forming the second bottom. This pattern is considered a bullish reversal pattern.

Bullish and Bearish Engulfing: These are candlestick patterns that occur when a small candlestick is followed by a larger candlestick that completely engulfs the small candlestick. A bullish engulfing pattern occurs when a small red candle is followed by a large green candle. Conversely, a bearish engulfing pattern occurs when a small green candle is followed by a large red candle.

Rounding Bottom: This pattern is characterized by a long-term, gradually sloping decline in price that is followed by a gradual rise in price. The bottom of the decline is rounded, hence the name. This pattern is considered a bullish reversal pattern.

Conclusion

We can conclude that the larger the pattern the greater the potential for a major reversal. As with any strategy, one cannot rely on merely patterns but must utilize other indicators as well such as volume pattern and measuring implications. These are approximations of the size of the subsequent move and determining reward to risk ratio.

Identifying Major Reversal Patterns

Aug 27, 2023

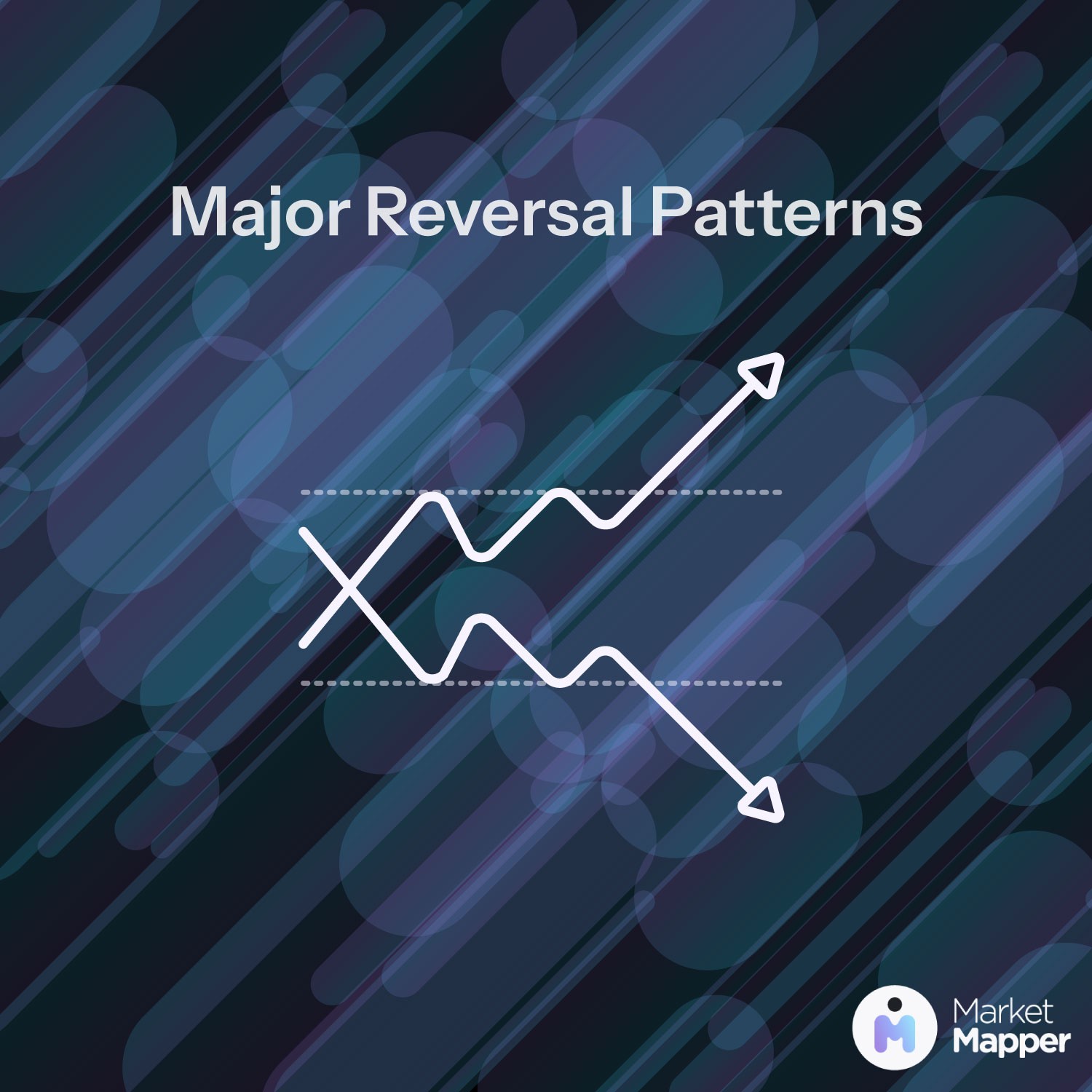

Major reversal patterns are a very important aspect of technical analysis in trading as they provide insights into the potential direction of price movement. Reversal candlestick patterns indicate that an important reversal in trend in taking place.

Types of Patterns

There are two type of patterns: reversal and continuation. But in this post we will be looking at reversal patterns. We often judge trends by the height of the pattern as that is most visually understandable. Though judging by the horizontal width of a pattern is mainly applied for point and figure charting (passage of time is non-existent).

Head and Shoulders: We notice this when a stock's price rises to a peak and then falls. Soon followed by a higher peak and then another fall. The second peak is lower than the first peak while the two lows are at approximately the same level. This pattern is considered a bearish reversal pattern.

Double Top: This pattern is formed when a stock's price reaches a high level, pulls back, then rallies again to the same level before pulling back again. The second rally usually has less volume, indicating decreased buying pressure. This pattern is considered a bearish reversal pattern.

Double Bottom: This is the opposite of the double top pattern. The first bottom typically has high trading volume and is followed by a bounce in price. After the bounce, the price declines again to the same level as the first bottom, forming the second bottom. This pattern is considered a bullish reversal pattern.

Bullish and Bearish Engulfing: These are candlestick patterns that occur when a small candlestick is followed by a larger candlestick that completely engulfs the small candlestick. A bullish engulfing pattern occurs when a small red candle is followed by a large green candle. Conversely, a bearish engulfing pattern occurs when a small green candle is followed by a large red candle.

Rounding Bottom: This pattern is characterized by a long-term, gradually sloping decline in price that is followed by a gradual rise in price. The bottom of the decline is rounded, hence the name. This pattern is considered a bullish reversal pattern.

Conclusion

We can conclude that the larger the pattern the greater the potential for a major reversal. As with any strategy, one cannot rely on merely patterns but must utilize other indicators as well such as volume pattern and measuring implications. These are approximations of the size of the subsequent move and determining reward to risk ratio.

Identifying Major Reversal Patterns

Aug 27, 2023

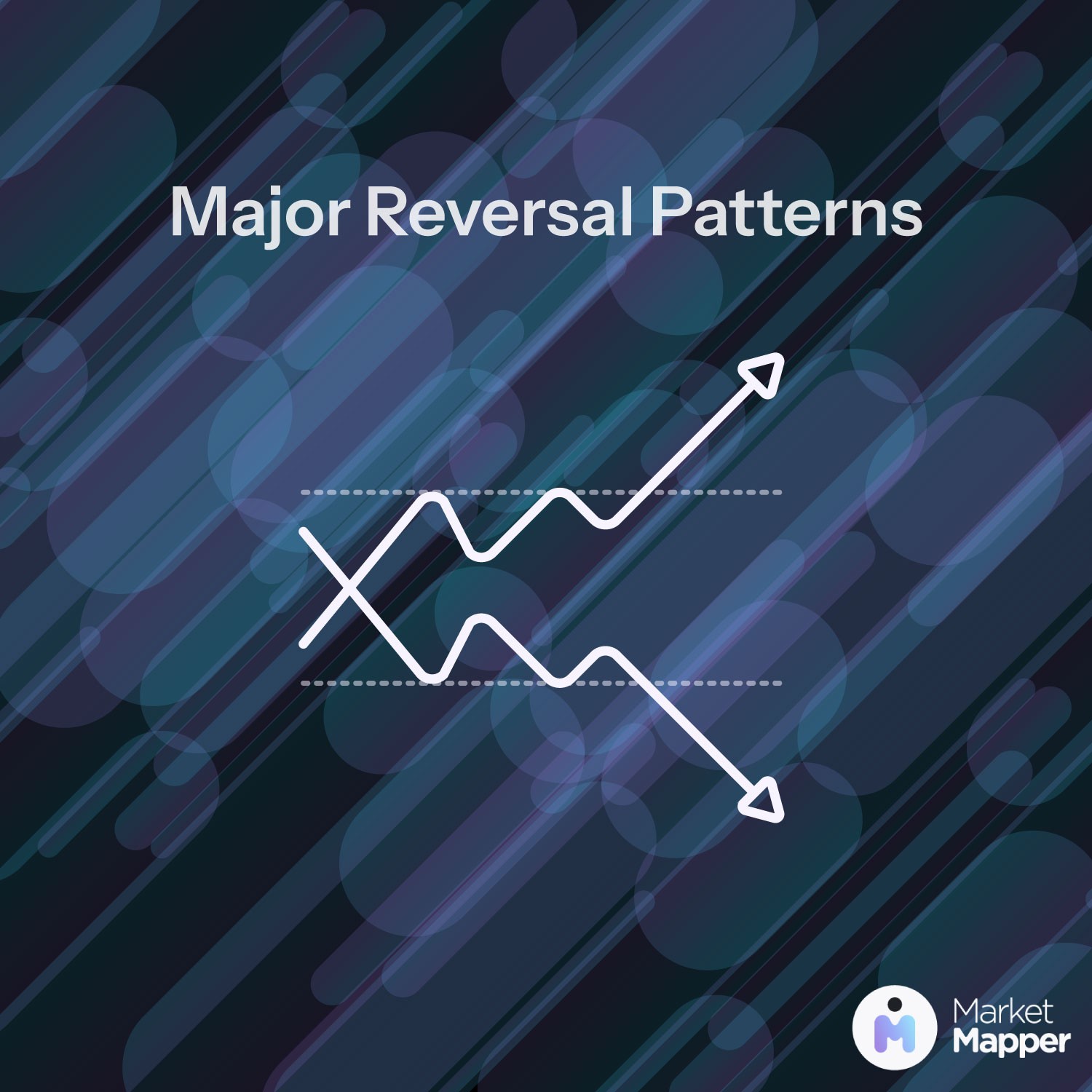

Major reversal patterns are a very important aspect of technical analysis in trading as they provide insights into the potential direction of price movement. Reversal candlestick patterns indicate that an important reversal in trend in taking place.

Types of Patterns

There are two type of patterns: reversal and continuation. But in this post we will be looking at reversal patterns. We often judge trends by the height of the pattern as that is most visually understandable. Though judging by the horizontal width of a pattern is mainly applied for point and figure charting (passage of time is non-existent).

Head and Shoulders: We notice this when a stock's price rises to a peak and then falls. Soon followed by a higher peak and then another fall. The second peak is lower than the first peak while the two lows are at approximately the same level. This pattern is considered a bearish reversal pattern.

Double Top: This pattern is formed when a stock's price reaches a high level, pulls back, then rallies again to the same level before pulling back again. The second rally usually has less volume, indicating decreased buying pressure. This pattern is considered a bearish reversal pattern.

Double Bottom: This is the opposite of the double top pattern. The first bottom typically has high trading volume and is followed by a bounce in price. After the bounce, the price declines again to the same level as the first bottom, forming the second bottom. This pattern is considered a bullish reversal pattern.

Bullish and Bearish Engulfing: These are candlestick patterns that occur when a small candlestick is followed by a larger candlestick that completely engulfs the small candlestick. A bullish engulfing pattern occurs when a small red candle is followed by a large green candle. Conversely, a bearish engulfing pattern occurs when a small green candle is followed by a large red candle.

Rounding Bottom: This pattern is characterized by a long-term, gradually sloping decline in price that is followed by a gradual rise in price. The bottom of the decline is rounded, hence the name. This pattern is considered a bullish reversal pattern.

Conclusion

We can conclude that the larger the pattern the greater the potential for a major reversal. As with any strategy, one cannot rely on merely patterns but must utilize other indicators as well such as volume pattern and measuring implications. These are approximations of the size of the subsequent move and determining reward to risk ratio.

Supercharge your trading game with Market Mapper today!