Management of Sorts: How Risk and Money Management Play a Key Role

Oct 10, 2023

Who doesn't want to know the magic sauce or ingredient that solves it all? Unfortunately, such a thing doesn't exist but you can certainly improve the chances of trading outcomes. We'll be observing key factors one should always consider in order to create or implement a particular tactic.

Money Management

There are various instances in which money management is applied. But specifically for trading, below are certain key points to keep in mind:

Risks for amount of capital invested in funds: Simply put, you should be very careful in how much total capital you commit to the markets. Reasons for this are obviously due to high volatility in crypto markets. As the saying goes, don't put all your eggs in one basket.

Diversification and concentration: Diversification is a way several traders try to minimize risk. Concentration is the complete opposite of diversification. The major concern with diversification is that if you're too "widespread", it can result in numerous minor losses but they all add up over time. Hence, diversification needs to be carried out strategically. Concentration on only one asset is very risky unless you have high conviction or it is Bitcoin.

Risk Management

SL and TP: The almost sole reason why ones uses stop losses is for creating a protective stop. Be careful here as though you are creating a stop in trades, if you are too eager to get minimal losses, you'll easily miss the timing of placing a good SL.

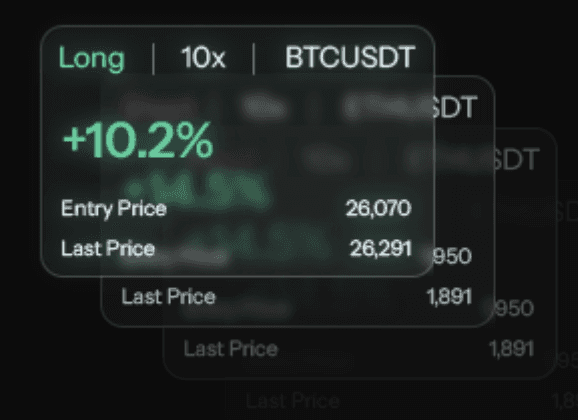

Taking in risk ratios: We need to ask ourselves constantly about the risks and percentage of probable reward. Staking too high can be extremely risky without thinking of further consequences. To fix this, determining a profit objective is best so that it is balanced against potential loss.

Controlling greed: When we have a streak of profits, what do we think next? How about placing all the profits and try doubling it? Please, please don't. It has been almost proven for decades that this particular timing is the worst to commit after winning multiple trades. Not only do we feel arrogant but we always feel the next trade will make even more profits. Assuming you made heavy losses, you will mentally take a heavy toll on yourself physically and mentally. We should try to prevent this as much as possible.

Conclusion

Now comes down to the question of how do I implement all of this? You as the trader must combine technical factors preferably with technical indicators and apply money management. Whether or not you use multiple indicators, have a diverse portfolio, etc., it is always best to stay alert and carry out proper precautions while trading.

Management of Sorts: How Risk and Money Management Play a Key Role

Oct 10, 2023

Who doesn't want to know the magic sauce or ingredient that solves it all? Unfortunately, such a thing doesn't exist but you can certainly improve the chances of trading outcomes. We'll be observing key factors one should always consider in order to create or implement a particular tactic.

Money Management

There are various instances in which money management is applied. But specifically for trading, below are certain key points to keep in mind:

Risks for amount of capital invested in funds: Simply put, you should be very careful in how much total capital you commit to the markets. Reasons for this are obviously due to high volatility in crypto markets. As the saying goes, don't put all your eggs in one basket.

Diversification and concentration: Diversification is a way several traders try to minimize risk. Concentration is the complete opposite of diversification. The major concern with diversification is that if you're too "widespread", it can result in numerous minor losses but they all add up over time. Hence, diversification needs to be carried out strategically. Concentration on only one asset is very risky unless you have high conviction or it is Bitcoin.

Risk Management

SL and TP: The almost sole reason why ones uses stop losses is for creating a protective stop. Be careful here as though you are creating a stop in trades, if you are too eager to get minimal losses, you'll easily miss the timing of placing a good SL.

Taking in risk ratios: We need to ask ourselves constantly about the risks and percentage of probable reward. Staking too high can be extremely risky without thinking of further consequences. To fix this, determining a profit objective is best so that it is balanced against potential loss.

Controlling greed: When we have a streak of profits, what do we think next? How about placing all the profits and try doubling it? Please, please don't. It has been almost proven for decades that this particular timing is the worst to commit after winning multiple trades. Not only do we feel arrogant but we always feel the next trade will make even more profits. Assuming you made heavy losses, you will mentally take a heavy toll on yourself physically and mentally. We should try to prevent this as much as possible.

Conclusion

Now comes down to the question of how do I implement all of this? You as the trader must combine technical factors preferably with technical indicators and apply money management. Whether or not you use multiple indicators, have a diverse portfolio, etc., it is always best to stay alert and carry out proper precautions while trading.

Management of Sorts: How Risk and Money Management Play a Key Role

Oct 10, 2023

Who doesn't want to know the magic sauce or ingredient that solves it all? Unfortunately, such a thing doesn't exist but you can certainly improve the chances of trading outcomes. We'll be observing key factors one should always consider in order to create or implement a particular tactic.

Money Management

There are various instances in which money management is applied. But specifically for trading, below are certain key points to keep in mind:

Risks for amount of capital invested in funds: Simply put, you should be very careful in how much total capital you commit to the markets. Reasons for this are obviously due to high volatility in crypto markets. As the saying goes, don't put all your eggs in one basket.

Diversification and concentration: Diversification is a way several traders try to minimize risk. Concentration is the complete opposite of diversification. The major concern with diversification is that if you're too "widespread", it can result in numerous minor losses but they all add up over time. Hence, diversification needs to be carried out strategically. Concentration on only one asset is very risky unless you have high conviction or it is Bitcoin.

Risk Management

SL and TP: The almost sole reason why ones uses stop losses is for creating a protective stop. Be careful here as though you are creating a stop in trades, if you are too eager to get minimal losses, you'll easily miss the timing of placing a good SL.

Taking in risk ratios: We need to ask ourselves constantly about the risks and percentage of probable reward. Staking too high can be extremely risky without thinking of further consequences. To fix this, determining a profit objective is best so that it is balanced against potential loss.

Controlling greed: When we have a streak of profits, what do we think next? How about placing all the profits and try doubling it? Please, please don't. It has been almost proven for decades that this particular timing is the worst to commit after winning multiple trades. Not only do we feel arrogant but we always feel the next trade will make even more profits. Assuming you made heavy losses, you will mentally take a heavy toll on yourself physically and mentally. We should try to prevent this as much as possible.

Conclusion

Now comes down to the question of how do I implement all of this? You as the trader must combine technical factors preferably with technical indicators and apply money management. Whether or not you use multiple indicators, have a diverse portfolio, etc., it is always best to stay alert and carry out proper precautions while trading.

Supercharge your trading game with Market Mapper today!